For Better, For Worse: Communicating About Retirement

A recent survey suggests that many couples are not communicating clearly about retirement goals and strategies, even as they approach retirement age. The couples surveyed were at least 46 years old with a minimum annual household income of $75,000 or at least $100,000 in investable assets.1

Only 41% said they handle decisions on retirement savings and investments together, and 73% disagreed on whether they had a detailed strategy for retirement income. Many couples also disagreed on when they would retire and whether they would continue to work in retirement.2

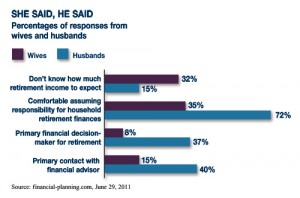

In general, wives expressed less confidence than husbands about handling retirement-related financial decisions (see chart). This trend is of special concern considering that women often have longer life expectancies than men and may eventually have to make financial decisions on their own.3

Talk It Over

Recognizing and working through these kinds of issues could help prevent unpleasant outcomes. Even if you and your spouse communicate well about retirement, it may be helpful to discuss these basic topics:

When each of you plans to retire. Where you would like to live. What kind of lifestyle you envision.

When each of you plans to retire. Where you would like to live. What kind of lifestyle you envision.- Whether either or both of you plan to continue with some type of work.

- How much income you expect when you retire, your expected sources of income, and your confidence in the amounts they could provide.

- How well you both understand your investments. Whether you both know where official documents are located and have all necessary account information.

Preparing for retirement can be a major challenge. Making sure you and your other half are in agreement and working toward common goals may help you avoid wasted effort and lost opportunities.

1–3) financial-planning.com, June 29, 2011

Rich Mino, a financial advisor with Del Mar Financial Partners, Inc., works closely with families and small businesses in the Carmel Valley area. He is passionate about making a difference in his community through financial literacy programs, and focuses on building strong relationships with all of his clients so that he can be a resource to them where needed most. An active member of the Del Mar Kiwanis, Rich supports his Carmel Valley community through local service projects, and by sponsoring the Builders Club and Key Club leadership programs at Carmel Valley Middle and Torrey Pines High Schools. In 2012, he is working to implement a financial literacy educational program to help prepare and educate kids with the challenges that they will face as they begin and graduate from college. He is a registered representative of Securian Financial Services, Inc., Member FINRA/SIPC. Securities dealer and registered investment advisor. Del Mar Financial Partners, Inc. is independently owned and operated. 12526 High Bluff Drive, Suite 280, San Diego, CA 92130. 438300 DOFU 01/2012

Rich Mino, a financial advisor with Del Mar Financial Partners, Inc., works closely with families and small businesses in the Carmel Valley area. He is passionate about making a difference in his community through financial literacy programs, and focuses on building strong relationships with all of his clients so that he can be a resource to them where needed most. An active member of the Del Mar Kiwanis, Rich supports his Carmel Valley community through local service projects, and by sponsoring the Builders Club and Key Club leadership programs at Carmel Valley Middle and Torrey Pines High Schools. In 2012, he is working to implement a financial literacy educational program to help prepare and educate kids with the challenges that they will face as they begin and graduate from college. He is a registered representative of Securian Financial Services, Inc., Member FINRA/SIPC. Securities dealer and registered investment advisor. Del Mar Financial Partners, Inc. is independently owned and operated. 12526 High Bluff Drive, Suite 280, San Diego, CA 92130. 438300 DOFU 01/2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2012 Emerald Connect, Inc.

You must be logged in to post a comment Login